I am going to get right to the point: Insurance companies are screwing patients.

I have to admit it: I'm a little biased.

While I am sure that from time to time, insurance companies are presented with authorization requests for services that are either inappropriate or not medically necessary, these type of requests are in the minority. I also am aware that sometimes insurer guidelines can help a patient get appropriate care, and that insurance companies are not social service organization that can operate at a loss.

However, I am writing here to document how, with increasing frequency, health insurance companies are delaying and denying care in a manner against common sense medical judgment. These denials, which are made to favor profit margins, and which go against the recommendations of the treating physicians, are made to the detriment of patient health outcomes. Though I will show on this webpage selective cases to illustrate this abusive and inhumane behavior of insurers that I am seeing as a provider, I am also writing to hopefully instill in patients and healthcare consumers a degree of anger and a will to appeal and fight back. Regardless of what anyone else says, my experience as a physician has taught me:

--As for-profit businesses, the insurance company serves their shareholders, not patients or doctors.

--The insurance company superpower is SHAMELESSNESS.

--In reality, insurers are never penalized for their bad behavior.

--Due to insurer ability to influence politicians, there is no political will to change anything.

--For health insurers, preventing care is much more profitable than providing care.

--Insurance contracts are "take it or leave it" deals, leaving patients with no power.

Here is a video essay from NY Times from 3/14/24: "Medical Injustice Disguised as Paperwork," about the onerous process of prior authorization, used by insurers to deny care and inflate profits.

Every year, I spend more time fighting ridiculous and inappropriate denials and insurer delay tactics than ever before. I am not alone in my impression that health insurer policies reduce access to care.

I’m seeing more instances where the patient is being thrown under the bus by the insurance company at their most vulnerable time, when they are sick and hurting. Additionally, many patients are reluctant to complain about their inappropriate treatment for fear of losing their coverage altogether, despite the poor quality of their coverage. For the examples below, I feel certain that if the patient were the friend or family of an insurance executive, when it comes to providing timely and effective care, would also find that the denials and delays of the insurer, who has de facto control of healthcare (not the doctors!!), would also find the situation unacceptable.

I’m seeing more instances where the patient is being thrown under the bus by the insurance company at their most vulnerable time, when they are sick and hurting. Additionally, many patients are reluctant to complain about their inappropriate treatment for fear of losing their coverage altogether, despite the poor quality of their coverage. For the examples below, I feel certain that if the patient were the friend or family of an insurance executive, when it comes to providing timely and effective care, would also find that the denials and delays of the insurer, who has de facto control of healthcare (not the doctors!!), would also find the situation unacceptable.

It seems to me, as noted by this article I found online, that regarding insurance companies, "their job is not to pay for healthcare, but to avoid paying for healthcare. It is a terrible system.” There is an inherent conflict of interest, since for every bandaid or aspirin covered by a for-profit insurer, there is less money for them. And they need the money.

I am sharing challenges I have had in getting care approved for my patients with examples below. Though due to HIPAA regulations, I can’t share all of their details, but all the patients involved in the cases I mention would be glad to corroborate how insurers denigrated the quality of care they received, and how care was delayed or denied, all inappropriately. Also, I have learned that the patient is not actually the client of the health insurance company. The client is the entity paying for the policy, which in most commercial cases is the employer, or for government coverage, state or federal government, with thoughts echoed in this enlightening video about why health care customer service is so bad: they don't need to care about patients.

Apparently, the only basis on which to sue a health insurance provider would be on a contract dispute, and the terms and agreements for any person signing for insurance coverage are so heavily weighted towards the insurer that these suits almost never are filed. And like with justice, medical care delayed is medical care denied, and the insurer saves bundles by avoiding medical expenditures.

Probably I need to just be quiet and accept that what is occurring here is the new world order. Just as this video shows how Amazon with their near monopoly of online sales is driving up prices with unfair practices, and exorbitant drug prices are caused by another layer of middlemen called pharmacy benefit managers, what is more obvious to me over the last few years is that the corruption has become an inherent element of the entire healthcare system. Despite having the most expensive health care system, the United States ranks last overall compared with six other industrialized countries. I guess we DO have this shining example of American exceptionalism.

Given that the business model of insurance is to take in premiums (their income) and then have as little outflow of money as possible (their expenses), insurance companies are highly incentivized to be as obstructive as possible in order to maximize their profits. Just by their administrative involvement, care is delayed processes, and quality is compromised. The insurer has de facto control of what happens to patients, which means that they are practicing medicine without a license. And, due to healthcare insurers being able to contribute essentially unlimited amounts to influence lawmakers, I have little hope that things will change.

However, I at least want to be clear about what I am seeing as a provider. We are not fighting on a level playing field, and the other side that is willing to use unethical and immoral techniques in their battle to gain larger and larger profits for their involvement in the delivery of healthcare, even stressing hospitals. More and more, when I see patients staring back at me asking how their care can be denied, I share my impression that the insurer could not care less. I often share my thoughts that we are not dealing with respectable adversaries.

Here is another article with a corroborating opinion that when insurance is running the show, both doctors and patients lose.

So, here are the new rules:

The insurance company is your doctor, and they could not care less about what happens to you.

(Though this page is quite long, and probably should be a book or e-book, I'm sharing here my anger about how poorly patients are treated these days in the intersection of capitalism vs caring. Spoiler: caring loses. While I would like to think that some change will be coming, or that there's hope for improvement, these days with those in Congress more concerned about getting viral social media exposure, and with politicians always needing money (institutional corruption), our leaders instead just keep kicking the can down the road.)

🙁

Irreconcilable differences: Providers vs Insurers

While I will admit that there are some less than ethical providers who, seeing a patient with a pulse and insurance card, will bill whatever they can, this group is a small minority.

The vast majority of medically trained healthcare providers have empathy for the patient in front of them, and have to consider the whole picture, the social situation, risks of non compliance, and a number of factors beyond the simple "guidelines" (see below) used by insurers to optimize (i.e., deny) payments. Providers are trying to provide care, and insurers are trying to provide a profit for themselves and their shareholders. We are in charge of taking care of people. Insurance companies are in charge of making money.

However, with increasing frequency, with examples cited below, insurers (through their medical benefit managers) are augmenting their profits through actions that are with increasing frequency inappropriate or even are in bad faith.

Though most patients and many of my colleagues that accept insurance company control of medical care is a fait accompli, and though I also understand insurers cannot stay in business operating at a loss, I am seeing that while insurance profits soar, more patients are inappropriately denied with prolonged suffering. Though I feel powerless to change anything, at least I can help bring clarity to what I consider to be abuses within our healthcare system.

From a quick online search (and feel free to search yourself), I noted the following:

In 2022, the health insurance industry saw a 29% increase in net earnings to $24 billion. The profit margin also increased to 2.4%. Here are some of the largest health insurance companies and their 2022 profits:

UnitedHealth Group: $20.6 billion

Cigna: $6.7 billion

Elevance Health: $6 billion

CVS Health: $4.2 billion

Humana: $2.8 billion

Centene (Ambetter): $1.2 billion

Shareholders look at the bottom line, and they don’t focus too much on how the bottom line is improved. I mean, seriously, how many investors in Amazon are worried that the people who ship and deliver the items don’t get a break and have to pee in a bottle to avoid having a salary reduction? I doubt there are many shareholders or insurance executives that lose too much sleep over the types of insurance actions that I see being done to patients, delaying and denying care. They all just want their dollars to grow, and their next thought is “hey, you going to the game on Monday?”

Another teeny detail: Insurance companies have all the data and all the money. They have already been able to influence legislation so that they can’t be sued for their actions, and with their additional lobbying dollars, the can make the easiest argument to make for their political donation recipients: Hey, here’s some money, now just don’t change anything!

Here is a link to several different investigations into how insurers deny care to help their bottom line: click here.

Oh, and btw, after they deny your claim, you often can't find out why: click here.

Honesty in Marketing??? Ha!!

If you bought a car, or a large appliance, or anything really, you would want to have a sense of the quality of the product you are buying. Is this car going to stall in the middle of the highway? Will this refrigerator need to be replaced in two years? All reasonable questions, but with insurance products, not the case. By design, what they are selling, which is the opportunity to participate in a contract (written by them, to favor them) is so complex and vague that it's essentially impossible to understand. Plus, which patient knows what kinds of conditions are going to afflict them in the future?

Maybe a solution would be to have more clarity for patients who would be consumers of insurance products to know that they are buying. I would like to have a hope that a government agency will make them accountable for selling faulty insurance products. Then again, it would be interesting also to see pigs fly.

I recall generations ago, car accidents more often than not caused significant injuries. Ralph Nader, American lawyer and consumer advocate, published his book in 1965: "Unsafe at Any Speed: The Designed-In Dangers of the American Automobile" As a result of his exposition of the problems with American cars, change did occur. There was pressure on Congress so that safety standards were made mandatory. Translation: cars had to have seatbelts and lives were saved.

While I would like to think that maybe a basic standard could be implemented to allow the doctors to be the doctors, so that patients could actually get care in a timely, appropriate, and cost efficient manner, I think we live in a different world now. Insurance companies with their lobbyists (and the effects of their donations on politics) are too strong. According to this article, healthcare insurers as a whole spent $713.6 million lobbying federal policymakers in 2020, compared to $358.2 million in 2000. Norms are gone, members of Congress have to spend a disproportionate amount of time raising money, and many of our leaders spend more time trying to be social media stars than working on any common sense policy. We live in a world where we can't agree even who is the president. For all intents and purposes, there is no penalty for insurers to conduct themselves in an immoral and inappropriate fashion, and therefore their first priority is profits. I have examples below of how insurer actions degrade the quality of care.

At a minimum, the healthcare insurance marketplace would be improved if there were more clarity about what insurance products patients might be purchasing, as even the names are deceptive. I have a great example with an insurance product that, due to its poor quality coverage, has been losing favor with providers in Georgia, despite the great sounding name:

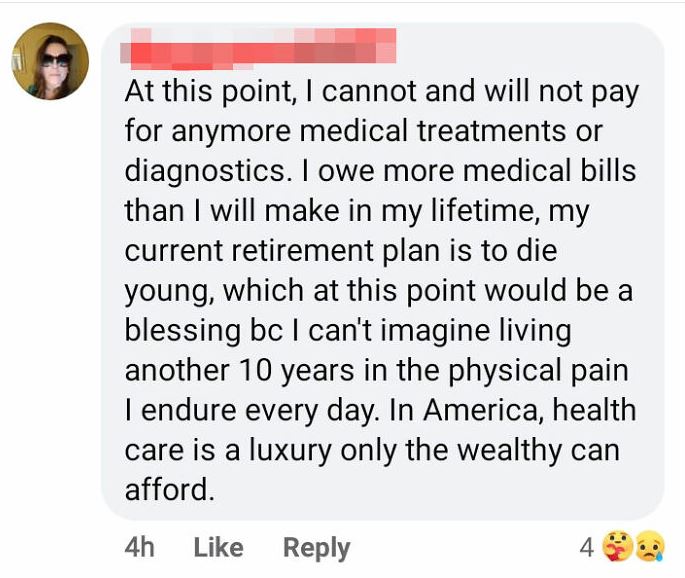

Ambetter. Look at the happy people on their webpage! Should be great, right? You even fell better saying the name!!

However, I have a whole webpage where I document my frustrations with this super low quality insurance product: drwolgin.com/ambetter.

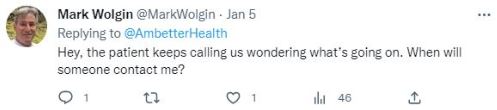

On this page (drwolgin.com/ambetter), I have details of the tremendous amount of push back and obstruction I faced to get approval for a patient who was getting paralyzed due to her spinal condition. I literally had to go on Twitter just to get a response, and the total time required between myself and my staff, time on hold, time writing letters, no less than six hours:

Other examples: I would see a patient for back pain. I would order physical therapy (PT). Ambetter denied the therapy. I would see the patient back and since they had at least access to some exercises on my website (drwolgin.com/lumbar-exercises-core-strengthening), and since they are getting worse, I ordered an MRI.

Ambetter denied the MRI...because they hadn't had PT.

It's a perfectly hermetically sealed system! Insurer takes in money, then denies any expenditures that could cost them money! And they can't be sued! Beautiful!!

I agree with what one patient said to me after having nearly everything denied, “they should be called AmWorse.” Though this company is widely known to provide very little coverage to patients I have seen, at least we can feel relieved since their CEO made over $13M last year, and they can still find the money to advertise at Nascar events. Apparently, I am not alone with my frustrations with this company as apparently as of July '23, a class action lawsuit was filed alleging Ambetter has a pattern of racketerring and a scheme to defraud its customers across 26 states including GA.

If the plans were appropriately named, the consumer could make an informed choice. Ambetter? AmWorse? Wouldn't it be more honest if the patient presented for care, and right on the card, it said something like "Garbage Insurance."

At least having an appropriate name would be a good start. This company is one example of marketing that is not honest.

So, how do insurers deny care?

Oh, I’m so glad you asked.

Though they have many strategies, we first have to acknowledge the inherent conflict of interest (COI) between caring for patients vs insurance company profit margin where caring for patients would negatively impact the insurer's bottom line. It's all about the Benjamins.

To summarize the treatment paradigm:

Nobody wants to be sick or be seeing a doctor. Most obtain some third party coverage (insurance company) for possible medical related expenses should they occur. When symptoms occur, patients will seek medical care, which for evaluation and treatment involves bills being generated. Most patients with coverage have a reasonable expectation that, having an insurance benefit, most of their expenses will be covered by their insurance plan.

HOWEVER, though there are some providers who upon seeing a patient with an insurance card and a pulse will bill for whatever they can, this group of providers (those who defraud payers) is a small minority. My experience is that the pendulum has swung way too far in the other direction, where the insurer will have a default position way more often than is appropriate to deny whatever is requested. Given that there is a percentage who won't fight that initial denial, this action provides an additional profit motive right there. I have seen insurers deny requested evaluations and treatment services in a manner that is inappropriate, and would not be acceptable if the insurance company executive were subjected to the same restrictions (good enough for you, but not good enough for me!).

The various reasons insurers offer for their denials, whether true or not, include these favorite phrases:

Procedure is not medically necessary. This excuse is one of their favorites, and in most instances, is without merit, bordering on bad faith. It has a ring like, "Thank God for the insurer! The doctor was about to suggest something that was not necessary! Hallelujah! The insurer will even double down by sending a letter to the patient with that wording, with the implication that the suggested treatments of the doctor are not appropriate (nearly always not true). The recommendations of the doctor in front of you, who actually saw and examined you, who explained the plan in a manner you can understand, was actually suggesting something that is "not medically necessary." You, Mr. or Ms. Patient, should be so glad that the insurer has protected you from this unnecessary intrusion into your life. Please. Give me a break.

Not covered by the policy. As noted above, first, who reads their policy? And second, if you did read it and want to negotiate about any details or provisions, do you think the insurer would change a word? What are you smoking?? The services they carve out (exclude) often make no sense, and they will arbitratrily cut out services that even a six year old would know is the right thing to do.

Procedure is experimental/investigational. This reason is another of their go-to expressions, even if the procedure is done commonly in the community. Though there are times when the suggested treatment lacks evidence, there are some times where evidence cannot be produced. A common example is that, technically, there is no evidence that parachutes help save lives for people jumping out of airplanes, since you can't find control group for the study: people jumping out of planes without the parachute. I have seen this excuse offered for treatments that clearly are standard of care in the orthopedic community.

Untimely claim. The application of this reason for denial in many cases would defy logic in anyone's mind. Technically, an untimely claim is a medical claim that is submitted after the insurance company has set a time frame for submitting claims. However, often the delay is caused by the insurer. For example, most insurance companies specify a 60 or 90 day period for submitting claims for medical services. If a claim is denied because it was submitted after the time frame has passed, the provider will not be paid for the services. That said, I have seen instances where the insurer uses other techniques to deny (and thus delay) the claim, and as we go back and forth in our appeal process, burning up time as the use their other reasons to deny covering the requested services, and then after the appeals break through and the medical logic is accepted, the insurer will then deny for taking too long. This reason for denial is another exercise of their shamelessness, as they give no credit to the fact that the time clock running was due to their obstruction during the appeal process.

Lack of prior authorization or referral. This issue comes up when unexpected issues occur, and they do occur. I have had times as a surgeon, where we approach the problem area, and find something unexpected, document that something, treat it, and then have the claim denied for lack of prior authorization. This excuse is both ridiculous and often made in bad faith. Even if we did suspect that the problem might be there, we can't get approval for "possible" procedures, and we can't request approval for conditions that were not apparent at the outset. I have heard from my ER colleagues that a patient will show up in the ER with the worst headache of their life (need to be sure there is no pathology within the skull, like a brain bleed), where an MRI or CT scan is ordered, it comes up negative, and for the charges for that service, the insurance denies the payment due to lack of pre authorization. Monday morning quarterbacking. Without the CT scan, how could the physicians have known the patient was not having a burst aneurysm, or intracranial hematoma (blood collection) or tumor? On what planet is this excuse appropriate?

Inaccurate physician coding. Though this reason could be valid, since typos do occur, I have seen more issues the other way, where the insurer finds some small detail to reject the claim. Here is an article that documents that claim processing errors by insurance companies cost patients and providers billions per year. In my experience, the insurer is more likely to use wrong codes to pay less, and their actions mean that our staff (who don't work for free) have to spend more time to appeal or correct their mistakes.

Incomplete or inaccurate insurance information. Though errors do occur, and health insurance fraudulent claims are a real entity, we often have trouble with someone who, for example, gets married, and the changes of name cause further delays in playment, which can run up against the timeliness of claim payment issue noted above. Any excuse to delay or deny results in the ball tipped in favor of the insurer.

Obstruction of and poor communication. In trying to help our surgery scheduler, my assistant was trying to contact various insurers for approvals for requested surgeries. In doing so, she documented delays and obstruction in getting questions answered, even in uploading documents (MRI reports and office notes: issues with their websites), and especially with any efforts to talk to a human. Part of the insurance business plan has to be hoping that either doctors or patients get frustrated and go away, since they certainly don't facilitate care being given to the patient.

Use of "guidelines." This reason is a big one, with examples below. Even the word "guideline" is a lie. The word should be "law." Insurers, through their subcontracted companies who interpret these guidelines (medical benefit managers, MBM's, example here), give no room for logic or common sense decision making to be applied. If a request doesn't meet their guidelines: denied. Do all of human conditions fit into their network of guidelines? Of course they don't. To me, a "guideline" is "don't get invited to dinner and show up empty handed," or "don't chew with your mouth open," more like suggestions. But for insurers and their hired gun subcontractor MBM's, these guidelines are a hard stop to deny care. I have had discussions with their physician reviewers who note that while they agree with my logic, their hands are tied by the "guidelines." I guess these physician reviewers need the money. While I am sure that there are inappropriate treatment suggestions that they see more than I do, in my cases, I have had these reviewers note in our phone call that they have no objection to my plan, but they can't go around the guidelines...I mean...laws of medicine. Pure hogwash and bad faith by the insurer.

Just make up a reason. There has to be a bad faith department. I have requested that a patient have a treatment plan A, and the insurer will deny the claim noting that treatment plan B is experimental. Wait, what? Nowhere in my records or my request for surgery is there any mention of plan B, but I guess none of the other reasons worked, so they apparently pulled plan B right out of their corporate buttocks as a reason for denial. (See section below titled "Inappropriate Use of "guidelines:" Case denied...because of insurer willful misinterpretation of surgical recommendation" for example.) I admit to have a failure of imagining this new and literally inventive strategy to deny their having to cover medical expenses.

In fact, nobody even know how often claims get denied: (click here)

The bottom line for them is the bottom line. No matter if the patient suffers, the insurance has to make money. More delay and more denial is better for the insurer.

Patients in the Work Comp system (another nightmare) get caught up in legal processes, which really is a limbo situation with no end, as these patients can’t use their regular insurance. There is a box on their regular insurance form that asks if the condition is work related. If they check “yes,” the private insurance claim is immediately kicked out. If they check “no” and the problem is related to work, the insurer will withdraw the money back from wherever it was paid, and there is risk of being charged with insurance fraud. Bottom line: Endless waiting.

Prior Authorization: Tool for denials and for moral injury to providers

The prior authorization process in healthcare, while designed to manage costs and ensure appropriate use of medical services, can have many negative effects on patients with some examples below. Also, physicians and other providers sustain moral injury which occurs when the standards of care are not upheld by, again, a for profit insurer, for the benefit of the insurer and the detriment, damage, and sometimes even death of the patient. Here is another article about how prior authorization is corrupting the process of delivering care, and is injuring providers in the process.

- Treatment Delays: Prior authorization typically involves obtaining approval from the insurance company before certain treatments, procedures, or medications can be provided. The time-consuming nature of this process can lead to delays in patients getting the care they need promptly. Insurers will delay approval of diagnostic procedures, surgeries, or more immediately harmful to a patient, for their medicines. The delays, which are essentially shorter term denials that require provider and patient energy to fight, can deny patients treatments to help with pain (allowing only a few pain pills in chronic pain situations) and can be life threatening (delay/deny blood thinners in patient with clotting disorder).

- Disruption of Continuity of Care: Prior authorization requirements may disrupt the continuity of care, especially if a patient is transitioning from one phase of treatment to another. Delays in obtaining authorization can interrupt ongoing treatment plans, potentially leading to suboptimal health outcomes. These delays often lead to prolonged hospital stays, since the hospital cannot knowingly discharge the patient to an unsafe situation. These deferred/delayed discharges lead to occupation of many beds that could be used for more acute patients, among other issues.

- Increased Stress and Anxiety: Patients may experience increased stress and anxiety while waiting for approval, especially if they are dealing with a serious health condition. The delays, while sometimes short term, have no indication for the patient about what to expect. If the insurer said the delay would reliably be three days, the patient can plan. However, when still not approved on day 3 for a medication, the patient has no idea if there will be approval on day 4, day 5, day 6, or day 99. Uncertainty about whether insurance will cover a recommended treatment can add emotional strain to an already challenging situation.

- Treatment Abandonment: Faced with hurdles in obtaining prior authorization or denial of coverage, some patients may choose to abandon or forego recommended treatments altogether. This can have serious consequences for their health, particularly in cases where timely intervention is crucial.

- Financial Burden: Even when prior authorization is granted, patients may still face financial burdens. Some insurance plans may cover only a portion of the cost, leaving patients with high out-of-pocket expenses. In cases where authorization is denied, patients may be forced to explore alternative, potentially more expensive or less effective treatments or medications.

- Administrative Burden: Both healthcare providers and patients may experience increased administrative burdens associated with navigating the prior authorization process. Healthcare providers may spend valuable time and resources on paperwork and communications with insurance companies, diverting attention away from patient care. Instead of being a partner in providing healthcare, instead the insurer often becomes an adversary. We certainly have many instances of our staff staying on long hold times waiting to get approval for a medication that the patient has been taking, and then suddenly we need to get a pre authorization. Of course, the insurer blames the doctor.

- Impaired Doctor-Patient Relationship: The process of obtaining prior authorization can strain the doctor-patient relationship, especially in many cases I have seen, the patient get a letter about the denial blaming the doctor. I have seen examples where we were falsely accused of not providing adequate information. Patients may become frustrated with the complexity and delays associated with the process, leading to dissatisfaction and a sense of being impeded in their healthcare journey. During the time required to deal with the insurer delays, the patient is still not receiving their care. They have less confidence in their doctor or other provider, and in the healthcare system in general. Alas, patients have little comfort knowing that their health insurance company at least has made record profits.

- Potential for Errors and Miscommunication: The manual nature of the prior authorization process can introduce the possibility of errors or miscommunication between healthcare providers and insurance companies. Such errors may lead to delays or denials, affecting patient care.

HOWEVER: New Federal Rule (might improve things): as of 1/17/24, Centers for Medicare and Mediciad (CMS) ruled that for insurers participating in federal programs, prior authorization requests must have a response within 7 days, and for expedited requests within 72 hours, and must include reasons for the denial (I know what that reason will be already: "not medically necessary," regardless of the facts!!). Of course, insurers argue that they need prior authorization to rein in healthcare costs, but (again, opinion here) they are already reining in costs through their denials and delays!

3/28/24: Another Example of pure insurer obstruction, for Carelon, medical benefit manager: On patient JT (MRN 94240), I had to do a peer to peer review to get approval for a pain management procedure that actually was approved immediately in the phone call (so not a question of medical indications), but the peer review doctor noted that they had no records on this patient.

I checked with our scheduler and on the Carelon page: THERE IS NO PLACE TO UPLOAD RECORDS.

The peer doctor then said we could fax records, but on the denial form: THERE WAS NO FAX NUMBER.

Carelon had again formed the perfect almost hermetically sealed system: Procedure denied for lack of records, and their system is pure obstruction for sharing the medical records. Great news for the insurer, terrible news for the patient.

Like for a mafia hitman: It’s always a good idea to outsource the dirty work

The insurance company can say they didn't deny the service, and that would technically be a true statement. But just like if you hired someone to kill your neighbor's dog, you can say (technically) that you didn't do the killing.

Insurers hire Medical Benefit Managers (MBM's) to do the dirty work.

Let’s take a minute to look at the anatomy of your insurance product.

Health insurance is a contract between a company and a consumer. The company agrees to pay all or some of the insured person's healthcare costs in return for payment of a monthly premium. Covered services typically include regular office visits with your doctor, tests, urgent and emergency care, hospital stays, prescription drugs, medical equipment and more. The gist of having health insurance is that, in exchange for paying insurance premiums, health related costs will be mostly covered. However, the line between covered and not covered is both vague and is the essence of the financial conflict of interest between the for-profit insurer and the patient looking for care.

The essential transaction of the health insurance product is that for payment of money in advance, a significant portion of health costs will be covered. However, the dollars available to cover those costs are not unlimited, and insurance companies are not in business to lose money. As for-profit businesses, insurers will have to say “no” from time to time, denying coverage. Though I will admit that there is a small percentage of providers who, upon finding a patient with a pulse and an insurance card, will find reasons to submit a bill with fraudulent indications for the requested services, that group of providers is a very small segment of the pool. Under the guise of trying to protect themselves from being charged inappropriately, insurers have swung the pendulum way too far in the direction away from helping cover costs for healthcare services, and instead favoring them, to the detriment of providing quality patient care.

(Side note: While I do recognize that insurance companies cannot operate at a loss, and that they do need to be compensated for the added value of spreading risk among a population of patients, my objection to how they operate is the increasing frequency of unethical, inappropriate, and bad faith actions I see them take, with examples below)

However, if a patient goes to a doctor who diagnoses and treats the problem, and the insurance company can be perceived as getting in the way of the delivery of that healthcare, that obstruction can look bad for them.

In order for the insurer to have plausible deniability for saying “no,” for drawing the line to exclude which services are not covered, many insurance companies outsource that activity to a company that "manages" or "optimizes" the benefits, a medical benefits manager (MBM). There are various companies that offer these services, like Optum, Carelon, and Evicore.

While the stated goal of these "managers" is to “improve affordability and clinical excellence for populations with complex conditions,” I can tell you from my personal experience as a physician, with this trend accelerating in the past decade, the only role that these managers fill is to deny care. In reality, that stated goal is exactly the opposite of those description words that I copied from the website of one of the MBM’s.

These MBM’s don’t improve affordability, but because patients in acute need are faced with either going without or paying out of pocket for the acutely needed medical services, they worsen affordability. They do improve insurance company profitability.”

These MBM’s don’t improve clinical excellence, but by standing in the way of the treating doctor and the patient in need, they worsen clinical results (see cases below).

Never once has either an insurer or their MBM suggested any alternative treatment for a patient. They only say "no." Like a baby learning to speak, they have discovered, and totally exploit, the power of the word "no." Since their denial are often devoid of medical rationale, I wonder if the reviewer sits at their desk with a spinning wheel like on Wheel of Fortune with one of three answers: “denied,” “not medically necessary,” or “denied as investigational.” Their denials often come without any understandable explanation. Don't get me wrong: their denials have an explanation, it's just that the explanation is made without a medically logical rationale. Their denials would be probably more honest if the paperwork sent to our office said “Denied because it’s Tuesday.”

Nearly every time there is an inappropriate denial, I will make an appeal to the insurer, which is directed to their MBM. Regardless of what might be implied by the shiny happy people in the ads for the insurance company, the insurer and their MBM show no evidence that they appreciate the urgency of needing to get medical services for a patient in need. Once they make the denial, I think they consider themselves done and are probably off to eat lunch. I hear of no efforts from the MBM’s to make the review or appeal process more efficient to help expedite patinet care. In fact the opposite is true. Obstruction is baked into the process. There is no financial incentive for the insurer or their MBM to lessen the prolonged times our staff has to stay on hold to get an appointment to speak with one of their reviewers. In fact insurer finances are improved the more they obstruct the approval process. Though I am supposed to speak with docs with similar training and clinical expertise, that match up often doesn’t occur. I have spoken with reviewers who are not peers. I have had “peer” reviewers who have been ER doctors, OB’s, and general practitioners. I recently had a review with a general orthopedist who doesn’t do spine surgery who was giving opinions on a spine surgery that he has never done. Though I will write in the medical record that the “peer” was not a peer and we have to request another appeal, more time is burned up. More delay.

I have had occasions where the reviewing physician is the same specialty, but they start the conversation with the statement that the denial cannot be overturned. So then...why are they even wasting my (and the patient’s) time? I have had peer reviewers note that they agreed but their hands are tied by the guidelines. (See sections below on guidelines.) I have asked some of these reviewers what they would suggest if they were treating the patient, and uniformly they will respond that they have no answer. I will offer to do a video chat and show them the images, but they decline noting that they would be then practicing medicine.

Wait…and they’re not at that moment practicing medicine with their denials?

In one case, I even asked the doctor, who I noted was clearly obstructing care, why she went into medicine. I noted I thought most people get into medicine to help people. Why are you doing this?...to which the doctor replied “I’m not going into my personal reasons for going into medicine. I’m going to end this call.” Why isn’t that recording made public?

Importantly, when I have made complaints to the Insurance Commissioner in GA, I have been told that since the insurer specifically did not make the denial, when their subcontracted MBM did, they (insurance commissioner) have no jurisdiction.

How great is that feature for insurers!! If engaged in some act that you wouldn’t want to brag about at your Thanksgiving dinner, always good to have “plausible deniability.”

Oh, by the way, here is an article noting that payers are hiring physicians with histories of malpractice. Only the best.

According to our guidelines, your requested surgery is denied because it’s “not medically necessary.”

Even the word “guideline” is a lie. The word should be “law.” But that law is written by a for-profit insurance company, with an appeal process that favors the insurer.

Apparently, guidelines are the laws of medicine, and they are defined by a for-profit company that I’m pretty sure did not go to medical school. I always thought a "guideline" was something like

–don’t get invited to dinner and show up empty handed

–don’t chew with your mouth open

…but apparently these guidelines/laws are immutable and not open to a common sense reconsideration.

Spoiler alert: the use of guidelines to determine medical necessity is abused, always in favor of the insurance company to improve their bottom line. Examples below.

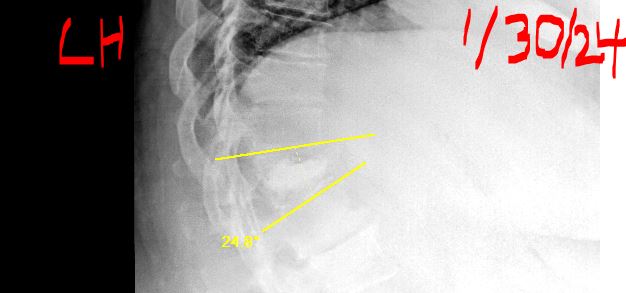

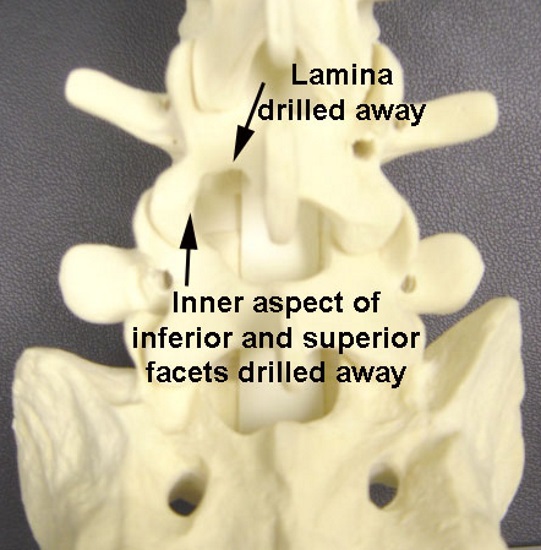

Inappropriate Use of "guidelines:" Case of LH, broken spine

Bottom line/Summary: with details below, due to the actions of the insurer's subcontractor Carelon, hired to "optimize" (i.e., deny) care, due to the denials and delays, this patient not only suffered unnecessarily for a prolonged time, but also had a clinical result that is below community standard, which is essentially insurer-induced malpractice, all of which could have been prevented by timely treatment (blocked by insurer).

Though a spinal bone was involved, the end result is no different than allowing any other fracture to heal in the wrong position, when timely treatment could have prevented a poor outcome. Most frustrating:

The insurer can't be held liable for the negative impacts of their non-justifiable decisions.

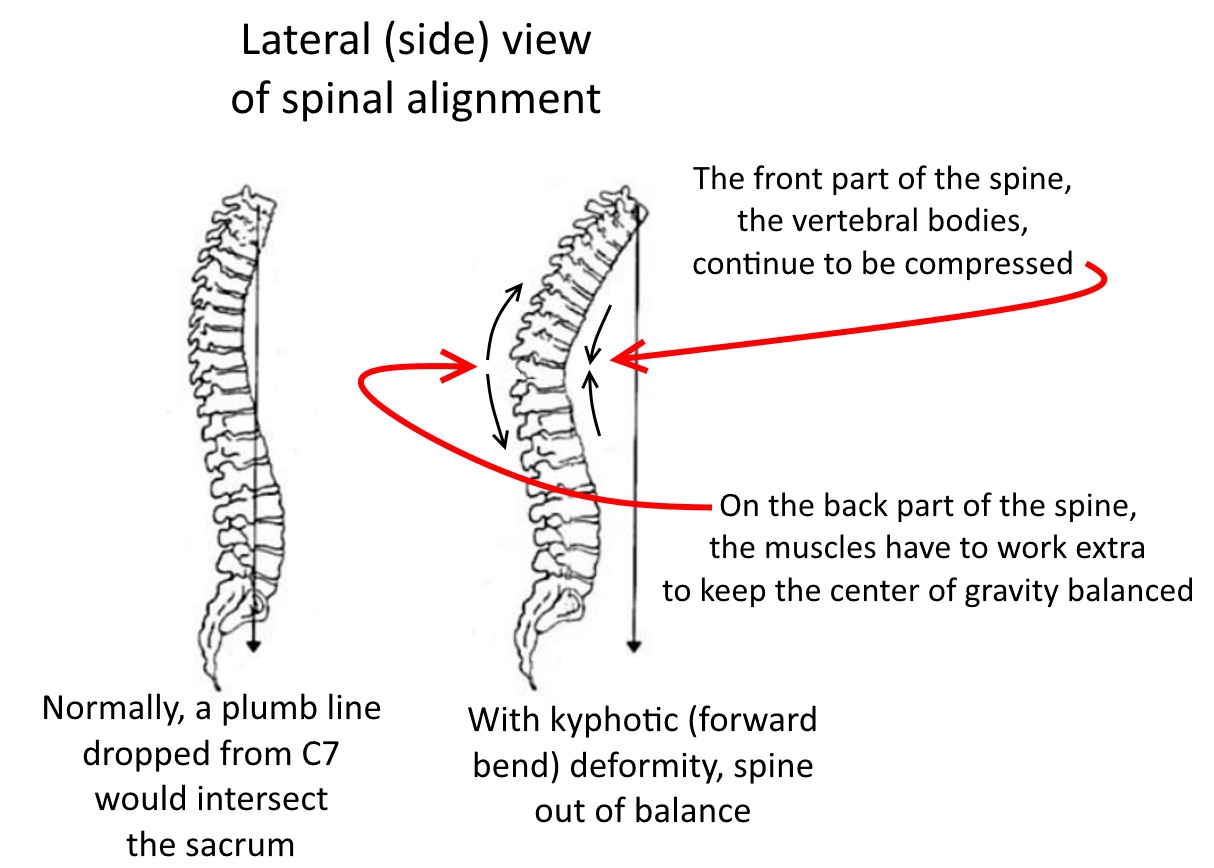

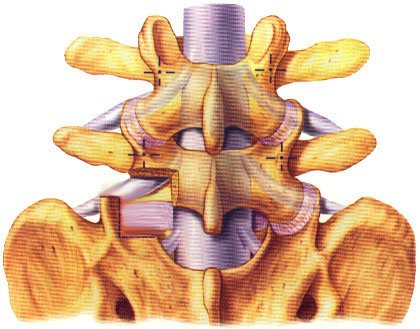

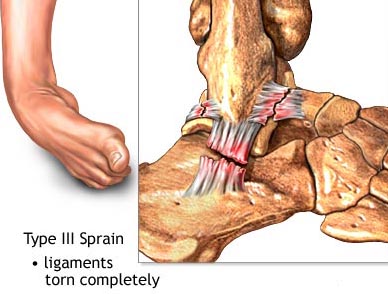

Patient LH (MRN 370340, BCBS insurance) was on her riding lawn mower 10/22/23, and a large tree branch weighing about 60 lbs fell on her. With the deforming force on her lumbar spine bending her forward in fraction of a second, she sustained a compression fracture of the vertebral body of T12 as noted in this schematic to the right -->

(and with her actual X-rays below)

Though not every compression fracture requires surgery, and though the patient did not have any neurological deficit (weakness or sensory changes of the legs or genitals), one of the indications for more aggressive intervention is intractable pain. Since the location of the fracture is between the stiff thoracic spine (the spine region stabilized by ribs) and the mobile lumbar spine, practically everything this patient would do would aggravate her pain.

One of the commonly used treatment options (and for which LH was a candidate) is a minimally invasive surgery called kyphoplasty, with a schematic of this procedure to the left. The patient is put to sleep, and through two small incisions, one on right and one on left, done with X-ray guidance, a needle is placed into the bone, through which a balloon is placed that will increase the height of the compressed bone. The balloon is removed, and then bone cement is placed in this area created by the balloon. This cement looks like toothpaste when it is introduced, but is a quick drying plastic that hardens in about ten minutes. Usually, much of the height of the compressed vertebra is restored, and the patient has immediate relief. Despite the risks, this surgery very often results in a happy patient.

As a surgeon, I don't sell surgery, and I note that the only guarantee is no guarantee, and that there are risks. With all these warnings, LH chose surgery. Even with pain medications, she found the pain intolerable.

Consider for a minute the subjective state of intolerable pain. Though we cannot cure everyone's pain, in this situation with a T12 compression fracture, the options are physical therapy (PT), medications, and sometimes bracing. If you have a broken bone, how much is PT going to help, especially when any movement aggravates her pain? In fact, none of these treatments were giving any relief. As an illustrative example, imagine you had a clamp on your finger, or a vice on your head, and you couldn't get it off. Do you think you'll be able to get any rest? Can you ignore it? You would likely go to great efforts to get the pain relieved, and for LH, the cause of the pain was right in the middle of her spine.

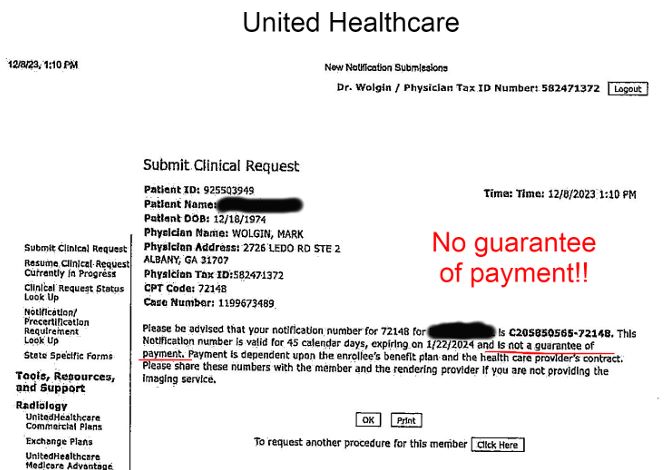

Appropriately, the patient was offered kyphoplasty, so we submitted the request for the surgery. I'm sure you can guess the answer:

Denied.

We appealed, and I had a chance to speak with their physician reviewer, a neurosurgeon, and explained the situation. At the beginning of the call, he noted that he could not reverse the decision (umm, so why are we talking??). However, he stated that he totally agreed with my plan, but that her particular policy had guidelines which included a “carve out” (sorry, we don't cover that!) for spinal trauma. Unbeknownst to apparently the patient, her husband (whose employer purchased their insurance), the benefits manager, and the branch the husband's city government employer handling benefits, none were informed that the "guidelines" of her insurance plan had an exclusion for spinal trauma.

I asked, since this physician reviewer is on the inside, can he start the appeal process? Get this: No. Not only couldn't he start an appeal, but he directed me to tell the patient to start that process by calling the number on the back of her insurance card. So, yes, here is a patient, LH, in intractable pain, who now gets an opportunity to go through the phone tree and endless time on hold and being shuttled around, and being told that the recommendation for surgery was "not medically necessary," that "the doctor's office had not submitted adequate documentation," (not true) that I was both in and out of their network (I am in), and any number of other reasons why the surgery could not be done.

I am not making this s*%# up.

There is a lot to unpack here.

--First, I am reminded again that insurance companies subcontract or outsource the dirty work of saying "no" to patients by hiring companies to do their medical benefits management (MBM). These companies "manage" the care with one common theme: delay or deny as much as possible. Like a mafia Don hiring out the dirty work to a hit man, insurers hire these MBM companies to say "no." Just to clear up any confusion, since I have been in practice since '93, never once has an insurer had a suggestion to actually help a patient. Like a one year old, they have learned the power of saying "no," and by definition, these insurance companies literally could not care less about the patient. For this case BCBS uses a company called Carelon to do the dirty work of the (inappropriate) denial. (I mentioned above about how an insurance company Ambetter who does their best to deny everything. Ambetter uses a company called Turning Point, and with their criteria here, since any submitted medical records have to meet all their criteria, which happen to be written to find something wrong with any case, since all medical records have to meet all of the criteria outlined on two pages, this other MBM for example technically can deny every case.)

–If the case reviewer spinal surgeon can't apply common sense medical judgment to a clinical situation, and approve a treatment, why was I even talking to him? Unless proven otherwise, the insurer was paying a surgeon to tarnish his own MD credentials to recite to me the rationale for denial with which their own reviewer even disagreed (below-standard care produced by insurer denial).

–If the insurer has a carve out or exclusion for spinal trauma, how was the patient supposed to know this detail? Was the purchaser of the insurance plan (the patient’s husband’s employer) made aware of this deficiency in coverage when they decided which plan to purchase? Did they say to their employees that they have great coverage, but just don’t break your back!! I'm sure that tucked into the fine print was language noting that they would follow "guidelines," but which patients know what conditions they will get, or have the bandwidth to ask for an research the guidelines? And would Carelon even give them out? I have asked, and they would not share them with me, and I even understand medical things!

--How is the failure to disclose gaps in medical coverage not deceptive marketing by the insurer?

–The neurosurgeon reviewer referred to the word "guideline," but even that word is a lie. Since apparently, the application of medical judgment is prohibited to get past the "guidelines," and since the insurer has de facto control of medical care and is practicing medicine without a license, a more appropriate word would be the "laws" of medicine.

–How is it appropriate that the patient has to start the appeal process, when she is not medically sophisticated, and in intractable pain? Could the insurer be more obstructive? Would they think this recommendation would be appropriate if LH were their sister or mother? Does the insurer have more information than I do, given that I am not only seeing the patient in front of me, but have to be held to a community standard of care? Again, could the insurer care any less? Time being of the essence? They couldn't care less. How is this activity not illegal?

Wait, there is more to the story.

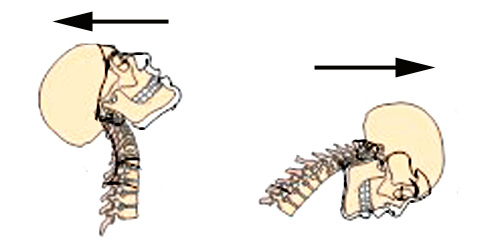

One of the issues with compression fractures at the thoracolumbar junction of the spine is that the alignment of the spine changes...for the worse. When viewed from the side, the center of gravity of most people is over their hips. If you put a bend in the spine, the center of gravity moves forward, basically putting the patient at risk of a lifetime of pain from the backside (posterior) muscles working harder and working overtime to keep the patient upright, to correct what is/was, when treated properly, a correctible problem. However, with the care being denied by their MBM Carelon, the for-profit insurance company demonstrates their conflict of interest, with their priority being on preventing medical care.

During the time that the patient's surgery was denied, she did in fact become more deformed (kyphotic = increased forward bend) at the T12 segment. This deformity could have been avoided or at least mitigated.

When the patient returned in December with the increased forward bend, kyphosis, we requested the surgery again, and again, surprise!!...it was denied. I asked our surgery scheduler to demand an expedited escalation of this case to a practicing spine surgeon.

I had on 12/19/23 a chance to do a peer to peer with Dr. AC, neurosurgeon, for Carelon MBM. First I had to assure whether he had the ability to apply common sense or could change the denial and initially he did not answer. He noted that the previous denial was because the patient had not had 6 weeks of therapy. (For the record, this explanation for the denial is not true. As noted the denial was that they excluded spinal trauma.) Since the option for actual appropriate care was in the hands of this reviewer, I did not want to argue, but the six week delay was not the reason given to me, nor has LH been able to tolerate any therapy. Simply, the insurer delayed any care for an additional six weeks (of patient suffering). Either way, I explained the situation and we were able to get an authorization number.

Should I be thanking the heavens that I as a spine surgeon can actually help a patient with spine surgery? Can I actually be the spine doctor on this spine case? Apparently, in this one hard fought moment, yes. And also apparently, I am being again taught that regarding medical decision making, the rules have changed.

But wait a minute: The plan as a carve out for spinal trauma, but now they are approving a case for spinal trauma? The approval goes against their own internal logic. How is this delay not purely bad faith?

I shouldn't have to be doing this, but I left this comment in the medical record of LH: "I also have to state for the record here in case there is any third party review, the delay by the insurance company was excessive, inappropriate, and caused unnecessary suffering. I strongly believe that if any of the personnel from the insurance company were subjected to this standard of delay and obstruction, they would find it unacceptable and would agree with my opinion. Clearly, profit over patient for the insurance company."

For the record, officially, the stance of the insurer is “Doctor, you can do whatever you want, but we’re just not going to pay for it.” Convenient for them, but most patients are reluctant to go into bankruptcy to face the financial risk of proceeding with medical procedures when they have medical insurance, feeling like they will be stuck with the bill. Again, the medical insurer controls how care is delivered.

Since the patient had thought she was covered with health insurance, to cover any issues that arise with her health, and since there is no way she could have predicted that she would either have a spinal fracture, or that her insurer would not cover this particular procedure, this action by the insurer, in my opinion again, reeks of bad faith, with some additional info from this link to a law firm that works in GA to provide some clarity. Also, again my opinion, not disclosing to their insurance clients that this insurance product doesn’t cover things like a broken back is a detail that reeks of deceptive marketing practices. I suspect that the insurer is technically covered, as in the reams of fine print that a potential customer either signs or doesn’t get insurance, there is language to cover their actions with vague terms written in favor of the insurer, but the spirit of the agreement is immoral.

Much like before 9/11, nobody would ever think that jet airplanes are actually bombs, why would LH think that her insurance wouldn’t cover her for a broken back?

I even wrote my own complaint on her behalf to the GA Insurance Commissioner: click here.

Not surprisingly, the GA Insurance Commissioner wrote back a contradictory response, that since there was no insurance plan, they had no jurisdiction. Huh.

Then, the next page had a response...from the insurance plan!!!!, with of course no acknowledgement of the fact that their delay caused irreparable harm to LH. By omitting the detail that their plan had an exclusion for spinal trauma, and last I checked omitting key details is a form of lying, the insurer is trying to defend the indefensible. And the regulatory agency does nothing.

Click here to see their responses and my responses to their responses.

And, as of 1/30/24 appointment, there is further update on her progress:

the forward bend in her T12 segment, that was 2 degrees on the October 30, 2023 MRI,

that was noted above to have increased from 9 to 13 degrees of kyphosis (forward bend)

was noted today to now be 24 degrees.

I even wrote in the medical record for this patient that this result, which is below standard of care, is generated by the behavior of the insurer...and nobody will ever hold them responsible for their actions.

Inappropriate Use of "guidelines:" Case denied...because the patient might also have other problems?

Bottom line/summary: Details below. As patients can and often do have more than one thing wrong with them, the insurer used the fact that this patient had other conditions to incorrectly and inappropriately deny the second stage of a two part treatment plan, using reasons that were irrelevant, as the first stage was successful. Even their own physician reviewer could not explain why. Denial is arbitrary and inappropriate.

Again, no insurer penalty for this inapproprate and below standard of care blocking of treatment.

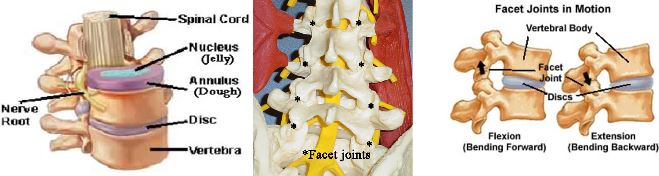

For patient JS (MRN 215920, Aetna Life Insur/Medicare Advantage plan), the carrier denied care after we had started our treatment process...because the patient might also have some other problems (who doesn't??)

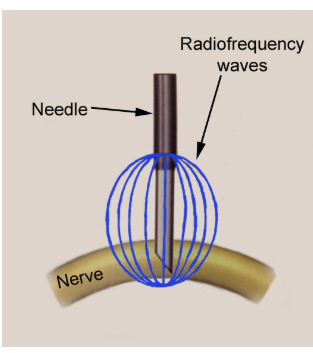

This patient, JS, was being treated for facet arthrosis, which is pain from the two small joints on the posterior aspect (back side) of the spine. Normal treatment (described briefly here) involves using a small amount of lidocaine (numbing medicine) either in the suspected facet joints, or to numb the small nerves to the joints, and if the patient has even temporary relief, that result is evidence that those particular facets are causing the pain.

This patient, JS, was being treated for facet arthrosis, which is pain from the two small joints on the posterior aspect (back side) of the spine. Normal treatment (described briefly here) involves using a small amount of lidocaine (numbing medicine) either in the suspected facet joints, or to numb the small nerves to the joints, and if the patient has even temporary relief, that result is evidence that those particular facets are causing the pain.

Most insurance companies required these blocks (called facet or medial branch blocks) be done twice before approving the longer lasting procedure called radiofrequency ablation (RFA) which involves using a needle to burn these small nerves and give 3-12 months of relief.

On patient JS, we did the first block in the lumbar region, and the result was successful. The patient has great relief for a day, which shows we blocked the right place. If the pain were from L45 and we blocked L5S1, we would not have had a successful result, as we would have missed the target to prove the source of pain. Of course since doing the second block is like putting one foot in front of the other when walking, we requested the second block. But, as you are probably guessing:

Denied.

I had a "peer to peer" conversation as a result of our appeal of the denial, and the notes I left in the medical record for this patient after that phone call tell the story:

"This note is made after a "peer to peer" phone call from a Dr. JR, a pain specialist, made as a "courtesy" since the request for medial branch blocks has been denied irrevocably. Dr. JR started the phone call with the disclaimer that the denial cannot be overturned (Umm..., why are we talking then?) and she could not make any change in the denial decision. Dr. JR noted that the case did not meet their guidelines.

I asked what the reason was for denial because doing a second block is standard of care, required by insurance companies, and is part of the treatment algorithm in these cases. Dr. JR noted that one of the issues was that their company had tried to contact our office on 11/7, leaving 3 messages, and that hearing no response, there was an automatic denial. Interesting. I learned after the phone call, when we checked our logs, neither my assistant nor our surgery scheduler had received any messages about this patient on that day. As far as I know, someone at the insurance company could have whispered my name in a soft voice in their office, and with my not answering (technically a failure to respond), processed the denial. Is the insurance company behavior acceptable? Could they care less?

I asked if that's how things go these days, that if we don't answer the phone in a certain amount of time that requested procedures are automatically denied? Dr. JR noted that answer was "yes." I also noted that I had no confidence that they actually called. I related that I have had times where a reviewer called our office when I was in surgery, the reviewer was advised that I was in surgery, and then we received a denial with the stated reason for the denial (letter sent to the patient, which patient shared with me) being that I did not answer their phone call. It would be hard for me to conjure up a better example of doing all they can to prevent health care, and their actions to me seem to be pure bad faith. Dr. JR noted that she was not going to debate whether or not the calls were actually made to our office. (Thank you, Dr. JR!!)

I changed subject to what Dr. JR suggests that we should do to actually HELP the patient. Although Dr. JR is a pain specialist and we were discussing a pain management procedure, she offered no suggestions. I noted that this type of interaction is typical for insurance reviewers. I noted that insurance companies only say "no" and though they are essentially practicing medicine without a medical degree, they never do anything to help the patient. Dr. JR noted that the patient has some evidence of radiculopathy with pain down into the leg and weakness and that those problems needed to be addressed. I noted, "Great! Dr. JR, what do you suggest?" Though I noted that patients can have more than one thing wrong, and that since Dr. JR was in the same specialty and since she has likely seen hundreds of similar patients, Dr. JR said "I will not answer that question."

I asked the Dr. JR what she would suggest if she were actually treating the patient and if she really has no suggestions, why she went into medicine if not to actually help people. Dr. JR noted she was not going to enter a discussion about why she went into medicine personally and then Dr. JR decided to end the phone call.

This conversation is another example of how the medical benefits manager (MBM) of the insurer for patient JS is assigned only one task: to deny care. I wonder if a deeper dive would reveal that Dr. JR would be dismissed from her position for insufficient levels of denied procedure requests. If the insurer cared about the patient at all (and their actions say the opposite), they would act differently. If any insurance executive were treated this way, they would have a seizure about how inappropriate this denial is/was. This case is another illustration of the conflict of interest between the for-profit insurer and the patient with medical needs and a treatable problem.

Here, by denying the second block, they also deny the RFA procedure, so it's like the insurer had a coupon: two denials for the price of one! That deal was one they could not pass up!

Also, hiring a doctor to speak with me is perpetuating a fraud, since the "peer to peer" process, is for show only. Why did they need a doctor to talk to me if the denial was irrevocable? These denials disrupt the doctor patient relationship, and are built in by design, putting profits above actual delivery of healthcare, and I hope the patient makes a complaint to the insurance commissioner (although I doubt they will do anything either).

Denials by a for-profit insurer instead of helping patients receive care appears to be the new world order, and another exercise of the shamelessness of the insurance industry."

I should not have to write this s*#@ in the medical record.

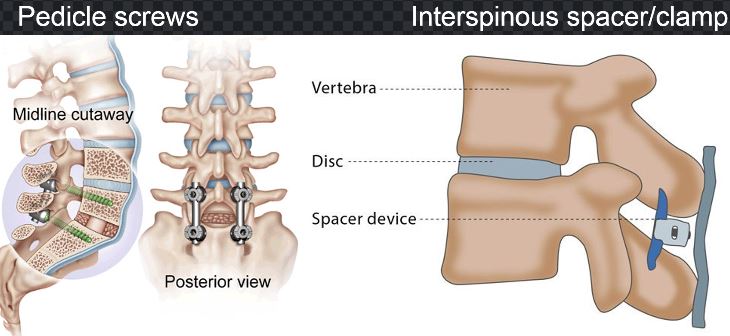

Inappropriate Use of "guidelines:" Case denied...because of insurer willful misinterpretation of surgical recommendation

Bottom line/Summary: Part of the proposed surgery to address the problem involves use of spinal hardware/implants, to allow the L34 segment to fuse. Though my description and all progress notes described use of pedicle screws, the insurer wholly made up a reason for denial, saying I was going to use a spinous process clamp (both pictured below). The insurer conjured up this false reason to support their denial: totally inappropriate.

**Apparently, the insurer can just make up any reason they want to deny surgery.

The insurer faces no penalty, no repercussions, no consequences, for this bad faith action.

(And btw, GA Insurance Commissioner, with regard to having any control of GA medical insurance for GA residents, responded that they can't help. Click here to see their response. And since they said I should complain to the Mississippi Insurance Commissioner, I did)

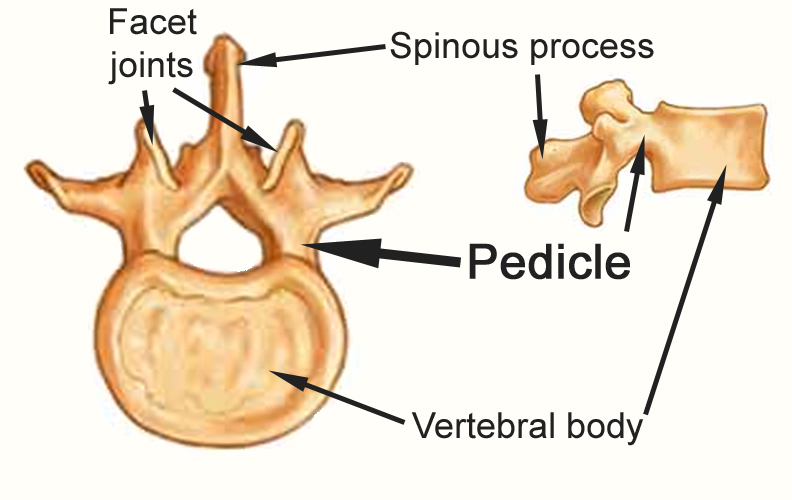

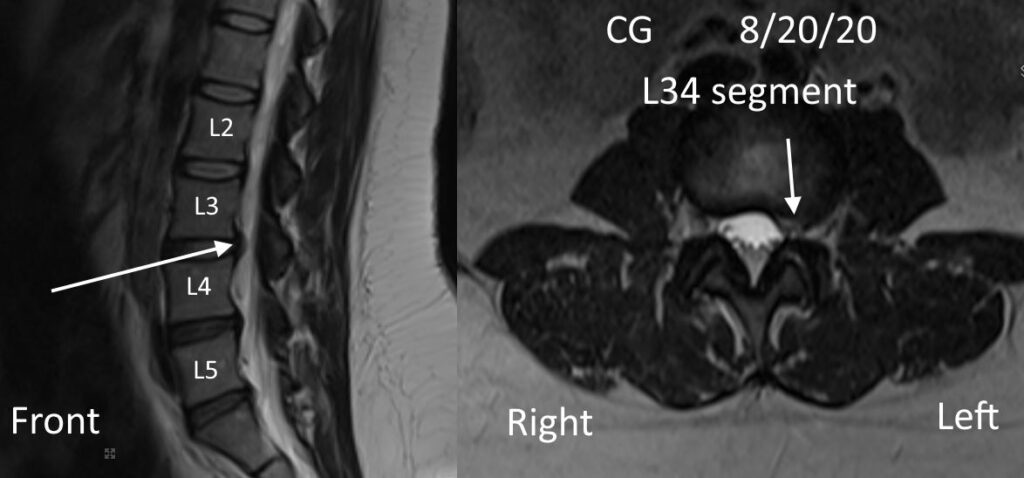

This case concerns a patient JM (MRN 254780, BCBS) who had a herniated disc on the left at L34. He had a re-herniation that requires treatment, but the insurer is making up ridiculous reasons to deny JM treatment.

This case concerns a patient JM (MRN 254780, BCBS) who had a herniated disc on the left at L34. He had a re-herniation that requires treatment, but the insurer is making up ridiculous reasons to deny JM treatment.

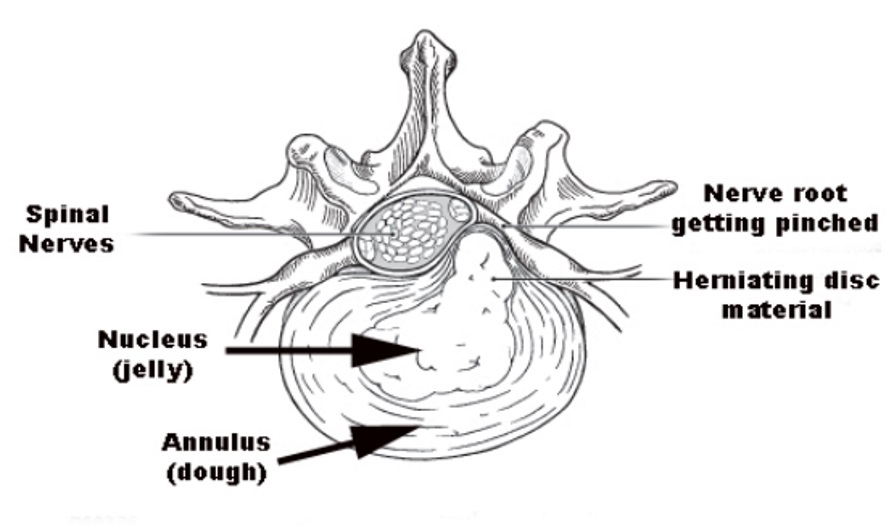

Anatomic info: The disc is the cushion between the vertebral bones, and has a structure that can be thought of like a jelly donut with a rim and a center. Sometimes, the rim will tear, and either bulge out to touch a nerve, or some of the center (nucleus) material will get extruded. Either way, a common way that this condition is treated is with discectomy, where through the posterior (back side) of the spine, a small amount of bone is removed to allow access to the bulging area to remove the disc and relieve pressure on the nerve. The procedure is illustrated below.

While in most cases, more disc does not come out of the opening in the annulus to cause recurrent pain, in the case of JM, it did. JM had relief for several weeks, but then his pain returned. Further imaging revealed that he had recurrent herniated disc material.

We unsuccessfully tried everything we could (PT, injections, nerve blocks) to avoid a second surgery, but none worked. Given that a focal nerve block gave him good relief for a day (diagnostic result to confirm the surgical plan), JM decided to proceed with revision surgery. .

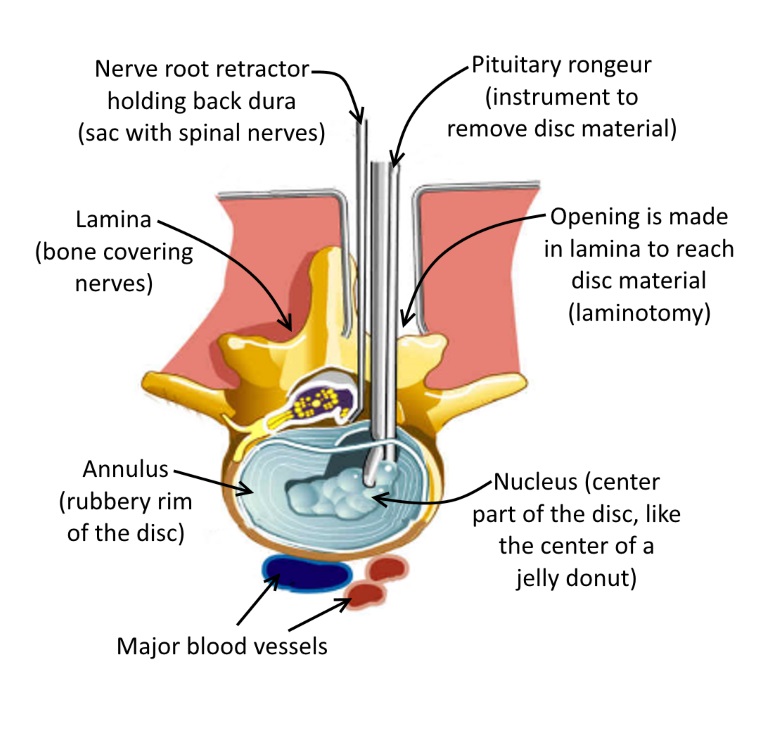

However, the revision surgery would be more involved. On the first surgery, we had to remove some of the facet joint to get in to do the decompression as shown here -->

To go into the same location, I can't remove more of the facet joint because only half of it is left as it is, so I would have to remove all of it, which would make the spinal segment at L34 unstable.

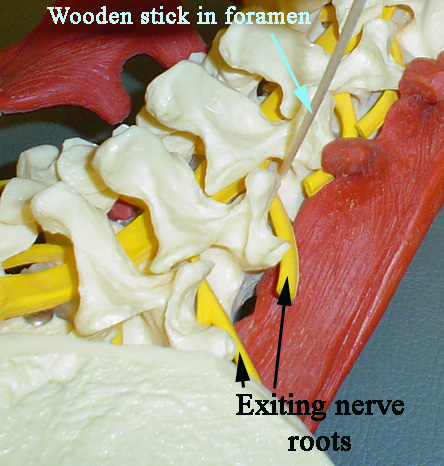

When we think of spinal stability, one can think of the model like a three legged stool, or a tricycle. If you take away one leg or one wheel, the structure becomes unstable (doesn't work right). We would gain stability at this L34 segment by fusing together the L3 and L4 vertebral bones. This fusion/stabilization is integral to the success of the surgery, and is a commonly done spinal procedure. The fusion is stabilized with pedicle screws (procedure code 22840) which is standard of care.

This information was submitted to the insurance company and since I’m sharing the details of this case here, you can imagine the response:

Denied.

The insurer explanation was that the code 22840 was judged as investigational, which is hogwash. On their own, the insurer decided to use the procedure code 22840 to describe a different type of spinal stabilization, a clamp that goes between the spinous processes, which I never mentioned in either my request for surgery, nor in my office notes.

To review some anatomic details (as illustrated to the left), the spinous process is the part of the bone you can feel when you run your finger down your back. The pedicle, which is the strongest part of the vertebral bone, is the tube of bone that connects the vertebral body to the anatomy on the posterior (back side) of the spine.

There is also a fundamental difference between pedicle screws and a spinous process clamp, as illustrated below with these two modes of fixation being clearly different.

I re-submitted the request for surgery again, even with these important clarifying details, and again:

Denied.

Their reason offered for the denial, which was the same reason, is complete garbage and a demonstration of bad faith. Though stabilization is essential for the case, the insurer would not approve this part of the procedure. It would almost be like, if the insurer had to authorize changing a flat tire, authorizing removing and changing the tire, but not re-applying the lug nuts. Ridiculous.

Nowhere in my request is there a mention of a spinous process clamp. Additionally, spinous process clamps are used and are not investigational, but are within the standard of care. Medicare covers them. Does the insurance company know better than a practicing spine surgeon how to treat JM's problem? Did they have any alternative treatment suggestions? Of course they don't. Just for him to get lost.

I think the insurance company would at least be more honest if their logo was a middle finger. As is the theme of this screed, they literally could not care less, except about preventing healthcare. The denial of this code is arbitrary, ridiculous, inappropriate, and immoral. Though my letter of complaint to the GA Insurance Commissioner was sent, as noted by their response (here along with my complaint to the Mississippi Insurance Commissioner, as directed by the GA officials) they have never helped a patient in my experience. I think they are the Commissioner For Insurance, not charged with helping patients or providers.

As of the time of this writing, the patient is still suffering with what is a treatable problem. At least the shareholders of BCBS are happy.

What’s a little cancer between friends? (i.e., more fun with "guidelines")

Bottom line/Summary: Despite my conferring with cancer professionals at my hospital, who all agreed that with this patient's strong family history of breast cancer that her cyst should have been removed based on the strong history alone, this patient's requests for cyst removal were denied for three years. I found no dissenting opinion among my oncologist colleagues.

Apparently, the "guidelines" are the laws of medicine, as they are immutable, but the laws are determined by a for-profit company, regardless of what is best for the patient.

Though this condition is not orthopedic, per se, I’m relating here another instance of insurance company “love” shared with me by one of my patients, MB (MRN 398720, Diversified Benefit Administrators), MB is a 53 yr old female with a strong history of breast cancer (mother, aunt, grandmother) who was diagnosed on physical exam as having a cyst in her breast at age 50 (three years ago). She wanted it removed then. Sorry, doesn't meet the guidelines (regardless of the opinions of the local oncologists that excisional biopsy was appropriate and indicated). Insurance would allow a needle aspiration, which was done at ages 51 and 52, and the small sample was negative for cancer. The patient wanted the cyst removed both for symptom relief and for a better sampling, but insurance denied the request, presumably since the aspiration was negative and completely disregarding the strong family history. At age 53, they allowed the aspiration again, and what do you know…Cancer.

The patient is getting her cyst removed in the near future, and her disease will be staged, but given that the aspiration is like putting a needle into a chocolate chip cookie, hoping that you can detect some chocolate (not a complete sample), and ignoring the strong family history of my patient and even the symptoms of discomfort that should be an indication for removal of the cyst, who knows how long the cancer was there without detection or a treatment plan?

Once a cancer cell is about the size of a pea that there are over a million cells within the mass. Who can really tell if the patient happened to be an insurance company executive or their family member, if they would have been happy with the same denials, even with a strong family history of the disease, if they would think the standard of care was met by the earlier denials?

"Doctor, though you're the surgeon, we only believe the radiologists." The obstruction is baked in.

Bottom line/Summary: Even though there is no orthopaedic surgeon who will read a report and then operate on a patient with out seeing the images, and even though there are no radiologists who do orthopaedic surgery, the insurer will believe only the radiologist's report of the imaging.

Though no insurance physician reviewer could explain the logic of the above statement, this rule is used to further delay procedure approvals in a manner that only protects profits, and prevents care from being given, again, with no consequence to the insurer this this inappropriate behavior.

Do radiologists have the expertise to know what details would affect a surgical outcome? Of course not. Have radiologists ever missed a finding? Of course they have. But no matter to the insurer. Any technique to throw in a delay or denial is pure music to their ears.

This case is another example where care has been delayed, and as of this moment, remains effectively denied. The case involves patient DC, a 62 year old disabled female (MRN 395070, Aetna Life Insur Medicare), who has failed conservative care, and who has an unstable spine, and surgery is denied.

First, a minute about what is an unstable spine? The spinal column has a number of segments, and for each level, there is a vertebral body in front, and two smaller joints in the back, called facet joints.

Inappropriate denial for surgery in a patient with spinal instability:

In the spine, the connection between two spinal bones, which includes the disc in front, and the two facet joints in the back, can be represented by a tricycle: big wheel in front (though on its side) and two little wheels in the back. Clearly, a tricycle without one of the little wheels in the back (without a facet joint) would not work right. The connection between two spinal bones would therefore have abnormal spinal motion at that segment. This abnormal motion is called instability.

As it turns out, my patient DC previously had surgery by another doctor, who removed the facet joint at L45, as illustrated in this schematic. This unstable segment is a textbook indication for a spinal fusion.

Not being 100% correct every time, in this case, the radiologist failed to note this finding. After speaking with him, he did amend his opinion, and document the lack of facet joint, but approval remains delayed. Also, the insurer wants this patient, with an unstable spine, to complete six weeks of physical therapy, even though the patient feels worse after every visit. Probably a more apt requirement is that the insurer wants the patient to complete six weeks of physical torture. However, even a hundred weeks of therapy are not going to make this segment stable.

I was able to arrange a review with their physician (because of course I have tons of extra time!) and made these notes in the patient's chart after this discussion with their reviewer. In these notes, I mention some of the points discussed above, and except for abbreviating name information, this text is copied directly from the patient's chart (except for my comments in parentheses). The reviewing doctor noted their decision was unfortunate (yes, it's unfortunate that I ran over your dog. My bad.), and as noted below, they approved only part of the surgery.

Wait...what? How is that decision any different than repairing only half of a damaged roof?

This note is made after a "peer to peer" conversation with Dr. K.C., neurosurgeon. Apparently, Dr. C is unable to apply any logic or give any explanation why the surgery should be denied, and instead hid behind the "guidelines" as if they are immutable laws of medical care, which for all intents and purposes, they are. Though to me, "guidelines" are broad recommendations (don't chew with your mouth open), they are instead apparently immutable hard stops in the decision making process. I wondered why we were even talking if there is no room for any logic to support my surgical plan. There was not. The insurer assesses the case to be either within guidelines, or not. The insurer has no interest in allowing the doctor (me), who is seeing and examining the patient, who is seeing films and who would be responsible for the result, to have any input. Instead, any opportunity to deny care is taken immediately.

Dr. C noted that even though I had documented that the patient has gone through physical therapy, and that the patient was only made worse by physical therapy, my documentation of this detail was not sufficient. I needed a discharge note from physical therapy. In other words, more roadblocks to helping the patient.

Dr. C noted that our office needed details about the proposed instrumentation which I provided for her in the phone call. Were they going to approve the hardware from one company but not another?

I noted for Dr. C that the patient at L4-5 was missing the inferior facet joint bone, indicating spinal instability. To be super simple for anyone reading this since apparently a neurosurgeon was unable to use this information to help get approval for this case, a spinal segment is like a tricycle. There is a big wheel in the front, which is the disc (which is actually horizontal and not vertical), and 2 little wheels in the back called facet joints which add stability to the connection where one spine bone connects to another. In this case, given the patient's previous surgery, the inferior facet on the right has been removed. This example is like a tricycle without one of the back wheels. By definition this segment is unstable. However, Dr. C would only accept the reading of there being an absent facet joint if she read it from the radiologist, as apparently my reading is not credible nor am I competent to read a CT scan. More options for the insurer to deny care.

Dr. C also noted that this insurance company policy was unfortunate to believe only radiologists, even though no radiologist actually ever made an incision on a person, and even though no surgeon would ever just read text on a paper and then did surgery on a patient. (Pure obstruction.)

Dr. C noted that they could only approve part of the surgery. I noted that that type of answer was ridiculous. Would any surgeon just do half the surgery? To think for a second, with this opinion coming from a neurosurgeon who at least previously practiced, that I would even consider for a minute going in and doing PART of the indicated surgery is both ridiculous and insulting. (More obstruction.)

I asked what the next process was since Dr. C was clearly is not in the business of helping the patient and Dr. C said that she cannot help but our office needs to put in a request for an appeal. (More obstruction.)

Once again, clearly, if the insurance cared for even one second about helping the patient, they would help facilitate this appeal process (as I am at this very moment trying to do) but rather, obstruction is part of the plan. Looking at the insurance business model, they take in premiums and the longer time they can delay care or deny care, the better their financial statements look, regardless of whether the patient who purchased the insurance product is getting value for the dollars they spent. The obstruction is by design. Let's at least be clear about how they function.

I will be sure to share this information with the patient and I hope they make a complaint to the Insurance Commissioner and any elected officials who will listen. Even if the insurance and healthcare system is entirely corrupt, which I expect it is, maybe this clarity can be known about how medical care is administered in this country.