Problems with Ambetter insurance

I have come to the opinion that Ambetter is a bait and switch operation, where they make promises to providers and to patients, but they effectively deny care by hiding behind complicated and effectively secret guidelines.

For more info, click here.

Insurance Denials of Care

Click here for an online commentary about insurance company behavior.

__________________________________________________________________

Insurance companies will impose a hurdle to delivery of care to have a “peer to peer” conversation about the individual patient’s case. Very often, as has occurred recently and repeatedly, I will receive a notification to call back this “peer”, who by the way is never a peer (an actively practicing spine surgeon), to have no call back despite leaving them my personal cell phone.

On the denial letter, there is always verbiage to the effect of “Peer to peer discussion was attempted but was unsuccessful,” which is partially true, leaving out the fact that they didn’t call me back (would have had a missed call or voicemail), or “Dr. Wolgin failed to call us back,” (wholly false).

However, that’s how these insurance companies roll these days.

__________________________________________________________________

In the past years, insurance companies have become more aggressive about denying care options for patients, and an illustrative example is noted below, posted here with consent of the involved patient (here called K).

The letter below was written to the Human Resources department of K’s husband’s employer, to advise them about how care is being denied.

As of the time of this post, the insurance company has told me to basically to get lost, as not only do they not have any alternative suggestions of what services they might cover, but they will not even discuss or reconsider the details of K’s case.

Apparently, United Healthcare is very comfortable just saying “no.”

To Human Resources (at the employer of this patient’s husband):

I apologize in advance as this email will be long. I am writing to help you understand how United Healthcare, a company you have contracted with to provide care to your employees, is behaving in this case.

I will include information below which I believe is helpful to judge how the United Healthcare is handling the case of K. I am not under any illusions that this discussion will change the coverage decision of the insurance company, but I hope that at least your company can know about the insurance product you have purchased for your employees and how care is being denied. K and her husband have given me permission to share details about their case.

I understand that insurance companies need to define which procedures they will and will not cover, but their exclusion of the AxiaLIF procedure especially in this case, is inappropriate. More importantly, my attempts to speak with a medical director have been blocked, and my questions were answered with non-responsive answers as will be detailed below.

To help elucidate the issues in this case let me outline the important facts:

K developed severe disc degeneration of L5S1 with pressure on her nerve roots causing pain to L leg with symptoms that failed to improve with nonsurgical care. In January of 2014, she underwent decompression (removal of the pressure on the nerve roots) and spinal fusion of the L5S1 segment, at the end of her lumbar spine. However, the fusion attempt was unsuccessful.

A fusion is where we try to create an environment where the bones grow together, fusing two bones into one. In this case, however, the fusion didn’t work creating a nonunion. I have some illustrative pictures from my website to show a union and a nonunion (not pictures of K’s anatomy, but included here to illustrate the point):

A fusion is where we try to create an environment where the bones grow together, fusing two bones into one. In this case, however, the fusion didn’t work creating a nonunion. I have some illustrative pictures from my website to show a union and a nonunion (not pictures of K’s anatomy, but included here to illustrate the point):

First, a fusion looks like there is bone connecting the bones, as illustrated here to the right.-->

A nonunion is where the bone doesn’t connect the bones with an example illustrated to the left.

In this case, K developed a nonunion and has continuing pain that significantly affects her quality of life, and for which there is a treatment option (but denied by United Healthcare).

Here is another detail: K is heavy, and getting to the spine is

a challenge.

Given that she has a nonunion, our options are:

–do nothing

–take pain medicines

–physical therapy (won’t make the nonunion grow together, and could aggravate her pain)

–surgery.

In order to fix the problem, to try again to get a union, surgery is recommended and is really the only option. Additionally despite the known risks, including there being no guarantee of success, the patient wants to proceed with surgery as her current level of pain is not tolerable.

Her surgical options include the following:

–go from posterior (backside) again: we have already done that, and can do it again but it didn’t work the first time.

–try to approach the L5S1 disc from the front, through the belly, but our vascular surgeon noted that approach is not an option in this case, vs

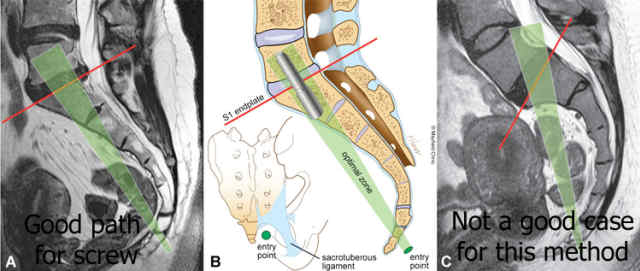

–the optimal approach, the AxiaLIF, where a screw is placed through a small incision through a tubular retractor in front of the sacrum, as pictured here to the right, along with reference to my website at this link:

This AxiaLIF procedure can be done in a minimally invasive fashion to give support between the vertebral bodies of L5 and S1 for certain cases.

One objection that will be detailed below is that United Healthcare has considered this procedure to be experimental. However, this assessment of the procedure is neither appropriate nor accurate. The acceptance of this procedure by Medicare and other insurers indicates that the surgical experience with this procedure is adequate to consider it as not experimental. Most insurance companies, including Medicare, generally don’t pay for doctors to experiment on their covered patients.

Here are some references to AxiaLIF being an accepted procedure:

Medicare coverage:http://www.beckersspine.com/orthopedic-a-spine-device-a-implant-news/item/10170-medicare-administrative-contractor-to-provide-coverage-for-axialif-next-year.html

Medicare coverage as of 1/1/12:https://globenewswire.com/news-release/2011/12/14/463715/240741/en/TranS1-Inc-Announces-Reimbursement-Coverage-Decision-Regarding-AxiaLIF-R-Procedure.html

Other insurance companies reimburse AxiaLIF:http://www.beckersspine.com/orthopedic-a-spine-device-a-implant-news/item/9631-more-insurance-companies-now-reimburse-for-trans1s-axialif.html

Cost savings are possible with AxiaLIF:

http://www.businesswire.com/news/home/20151110006015/en/Economic-Analysis-Demonstrates-Substantial-Spine-Surgery-Cost

In most cases where a specialized approach to a particular problem has to be crafted and might need to be discussed with someone at a high level at the insurance company, I have been able to speak with the medical director and a treatment plan was formed. However, with United Healthcare, there has been nothing but obstruction and denial of care.

I am including below notes about conversations I had with insurance representatives, but here are the main points:

–for a “peer to peer” conversation, they had me speak with a general surgeon. Since general surgeons handle appendectomies, gall bladder problems, and intestinal issues, and since they don’t do spine surgery, a general surgeon is only a peer in that someone would address us both as doctors. However, a general surgeon is no more qualified to give an opinion on a complex spine case than I would be to give an opinion on a technique for a gastric bypass: not qualified.

–I asked to speak with a practicing spine surgeon as a peer, but that request was ignored.

–my request to speak with the medical director has been denied.

–the insurance company has only said “no” and not offered any alternatives.

Here are notes from the patient’s chart:

Addendum Note (Mark A Wolgin, MD; 11/6/2015 12:16 PM)

This note is made following a telephone conference for what was supposed to be a peer to peer review. I had a call from Dr. DM, who is a general surgeon, not an orthopedic surgeon, and not a spine surgeon.

Dr. DM noted that the AxiaLIF procedure was not approved per the guidelines of United healthcare. I gave the opinion to Dr. DM that, understanding that he probably is not aware of this detail, the AxiaLIF procedure has its own procedure code and has been approved by Medicare thereby indicating that the procedure is not experimental.

I asked him what he suggested for this patient, and he did not have any answer.

Dr. DM offered to give me a reference to the guidelines for United healthcare, but instead I think the more appropriate course of action would be that I have a specialty specific peer to peer consultation with an orthopedic spine surgeon in active practice who is familiar with the AxiaLIF procedure.

It should be noted that when our scheduler arranged the peer to peer conversation for today, which was delayed from the conversation that was supposed to be yesterday, that our scheduler requested a practicing orthopedic spine surgeon. Apparently this message was not conveyed within the system at United healthcare.

One issue that should be noted in this case is that this patient is over 300 pounds, and she needs interbody support between the vertebral bodies of L5 and S1. The AxiaLIF procedure involves a minimally invasive technique to allow for anterior column support (between the vertebral bodies noted here) and our previous attempt to get an interbody spacer was not possible because the patient has had previous spine surgery and her thecal sac (the sac which contains the spinal nerves) was adherent/stuck to the posterior aspect of the disc.

I will be glad to discuss this issue further with a practicing orthopedic spine surgeon.

Other notes from patient’s chart:

The patient is here with continued frustration with her insurer, United Healthcare, who has explained to her verbally that the procedure that I am recommending, AxiaLIF, is still listed as experimental. The patient has submitted documentation from our office indicating that this procedure not only is not experimental, but there have been several thousand cases with successful results, and Medicare has a code for this procedure. Medicare generally does not apply codes for procedures that are considered experimental.

I was able to contact one of the executive from the AxiaLIF Company, John Miller, and I will put the patient in touch with that executive. Also he can provide some documentation about how the proposed procedure is not experimental. To me, it sounds like United Healthcare is willingly obstructing the patient’s plan of care without offering any alternatives or discussing the issues.

Since K has a documented nonunion of the fusion at L5-S1 and continued primarily low back pain symptoms, she remains a candidate for surgery. Another potential option for this procedure would be an anterior lumbar interbody fusion. However, while the patient was in the office today I checked with our vascular surgeon, and given the patient’s body habitus, she is not a candidate for this approach. Also, going from the posterior aspect would be significantly risky and very difficult to get into the interbody space. The patient clearly needs anterior column support as a posterior alone procedure would not be optimal.

Hopefully the patient can, through the administrative appeal process, get approval for the requested procedure. However, one issue that seems clear is that the insurance company is comfortable accepting the premium dollars from the patient’s husband (insurance company income), but they apparently are not comfortable spending these dollars providing actual medical care (insurance company expenditure). Also, we have made appeals through our office and I encourage the patient to send in this note also to United Healthcare to stand in and of itself as another appeal, noting here that I will be available at any time to speak with the Medical Director of United Healthcare so that we can discuss this case.

I will give the patient a copy of this report for her reference. I will also direct Jennifer in our office to fax a copy of this note to United healthcare with the attention directed to the Medical Director.

Addendum Note (Mark A. Wolgin MD; 3/28/2016 5:34 PM)

I received this message:

Deb S. forwarded a voicemail to my ext from Jeff (last name unintelligble, possibly Crenshaw??) at UHC Consumer Affairs 800-842-2656 ext 3042552. Voice mail states he received your correspondence and “it is unclear why you contacted this department.” Please call for clarification.

I left a message for Jeff on 3/28/16 at 1730 EST and left the office number and my cell phone number to hopefully get a call back.

Addendum Note (Mark A. Wolgin MD; 3/29/2016 1:23 PM)

As of 1:20pm on 3/29/16, I have not heard back from Jeff Crenshaw (?) from UHC, and I left another message at 800-842-2656, then pressed 1 to enter the seven digit extension 3042552.

I again left my cell phone in the message I left, along with the office phone number.

Will share a copy with K.

We still have not found out how UHC can deny a procedure that has a procedure code honored by Medicare as being “experimental.”

Addendum Note (Mark A. Wolgin MD; 3/29/2016 4:45 PM)

at 4:45pm, I tried again to call Jeff Crenshaw (?) at the same number, again leaving my cell phone and advising that I am in surgery tomorrow 3/30.

Still no response from him.

Addendum Note (Mark A. Wolgin MD; 3/29/2016 6:35 PM)

At about 5 PM, I received a call back from the United Healthcare representative whose name is actually Jeff G. We started the conversation with my trying to explain the clinical situation pertinent to this patient. He was at his computer, and I asked him to pull up my website, drwolgin.com, and I directed him to pull up the page under the section “Surgical treatments” with the subheading labeled “Lumbosacral fusion/AxiaLIF” so that he could understand the procedure I was requesting and the reasons for it. I spent significant time discussing with him the treatment options and how we could potentially proceed with our treatment plan.

However, we discussed the patient’s case for upwards of a half an hour, the bottom line became quickly apparent, that United Healthcare not only was denying the procedure, but they considered this case completely and irrevocably closed, and that the surgical request has been irrevocably denied.

There were several issues for which I thought that Mr. G’s response was entirely inappropriate and unacceptable. I will list these below although I’m sure if we explored how United Healthcare has handled this patient’s claim, there would be many more.

First, Mr. G felt that a general surgeon, which in this case was Dr. DM, a general surgeon with whom I spoke on 11/6/19, is appropriate as a “peer to peer” reviewer. I explained that a general surgeon is not a “peer” in any sense of the word. A general surgeon is not adequately trained orthopedic surgery any more than I would be an expert on gallbladder or hernia issues, and certainly is not trained in spine surgery. I also noted that when I asked Dr. DM what he suggested as a treatment plan for the patient, Dr. DM did not have any answers about how to treat the patient. Also, Dr. DM did not recognize that the procedure that was being proposed was approved by Medicare and was indeed not experimental. Mr. G felt that any medical professional could read medical guidelines and was appropriate to review these cases. Although I made very clear that Dr. DM, as a general surgeon, was not in anyway a peer, Mr. G stated he would not discuss this point further.

I also noted that in my discussion with Dr. DM that I requested to speak with a practicing orthopedic spine surgeon, but apparently that message was never relayed within the United Healthcare system. Mr. G again ignored this point since he felt that the peer-to-peer process had been fulfilled. Also, Mr. G asked me multiple times whether I recognized that the conversation with Dr. DM was a peer to peer review and that he wanted only a yes or no answer. I advised Mr. G that his question was akin to asking someone “is this the first time you’ve beaten your wife” where there is no good answer, but he kept pressing for a yes or no answer about whether I had a peer to peer review. When he rephrased the question as to whether the conversation with Dr. DM was PRESENTED as a peer to peer review, I agreed to that statement although I again noted that Dr. DM is not a peer, and that his phrasing begs the question of Dr. DM not being qualified to give an opinion about spinal surgery treatment options for K. I am sure that somewhere on his notes, he wrote down that I had a peer to peer consultation, which as noted here ad nauseum, was not the case.

Another point that Mr. G made which is also incorrect and inappropriate is that United Healthcare “is not guiding care.” Rather, he noted that the insurance company is only deciding which procedures they would pay for. When I noted for him that this distinction was artificial and missing the fact that patients buy insurance so that they can have coverage for their medical problems when they arise, and that in fact insurance companies do direct care all the time, Mr. G stated that what a physician recommends for his patient is an independent issue and the insurance company was only deciding payment. When I reminded him that very often patients restrict their treatment decisions to what an insurance company recommends and that in this case he and his company are essentially denying care for this patient, he again denied this point. When I asked about how the insurance company decision would affect the patient’s potential treatments options, Mr. G had no answer.

I even tried to phrase this question in a manner that would make the question potentially more relatable for Mr. G as an individual. I asked him if he had a treatment option that his doctor recommended that would cost many thousands of dollars versus one that the insurance company would cover, whether he would actually pay the many thousands of dollars to follow his doctor’s recommendation. He noted that he had been offered out of network treatment options in the past but again declined to give an opinion about how he would proceed if he were the patient in this case, noting he would not discuss hypothetical situations. I also noted for him that spine surgery is very expensive and that K cannot afford the types of expenses that spinal surgery would require, and that having coverage for these expenses is the main the reason why people buy insurance in the first place. Again, Mr. G declined to give an opinion in this regard.

I asked to speak with a medical director, and Mr. G said that the appeals were exhausted and the highest level person within United Healthcare that I would be speaking with is himself, Mr. G. I asked to speak with his supervisor and I got the same response.

When I tried to focus on the fact that we are trying to help the patient and that I wanted his opinion about what should be done to treat the patient with a spinal nonunion, he declined to answer noting that he is not a physician. I asked with whom in his organization I could speak to see what they recommend to help the patient, but he again declined to answer. When I asked him if he would want his family member treated in the manner that K is being treated, he specifically stated “I will not answer your question.” When I asked if we should then resubmit our request for surgery, he noted that that option is not available and no treatment for this patient’s problem will be provided, and that this issue has been closed.

Mr. G noted that a letter was sent out to the patient on November 19, a copy of which I did not receive, but that the appeal process lasted 60 days and now as far as United Healthcare was concerned, the appeals process is closed irrevocably.

When I asked Mr. G what the patient should do at this point, he stated that the insurance company could offer no further help at this point. When I again tried to focus the discussion on what we should do to help this patient and what they recommend, he noted “I am not going into philosophy in this discussion.”

I noted that Mr. G was doing a very good job of saying “no” to any proposed treatment, which would make great sense from a business standpoint, as the insurance company takes in premiums, and for every case they can deny, they save all that money for themselves. I noted for him that spine surgery is expensive, and that for every case they can deny, the insurance company would avoid paying out between $50,000 to $100,000 or more. However, he noted that my point was not applicable, since the company purchasing the insurance “was self insured, so we wouldn’t make a penny.” I found this response of Mr. G to be not only against all principals of business (profit is the money left over after expenses), but also disingenuous and most likely false. I also reminded him that in 24 years of my being a doctor that I have never had an insurance company suggest more treatment, but only deny.

When I asked him who else there is to talk to besides him, that I wanted to speak with his supervisor, he noted that there is no one else that I can talk to him this regard.

In summary, Mr. G did a very good job of saying “no” and that there would be no help for K despite the fact that her husband has been paying for medical insurance. From the standpoint of the relationship between a patient and their insurance company, where the patient pays money to buy insurance to cover possible medical expenses that could arise in the future while covered by that insurance plan, given that the result has been only to deny care with no effort or suggestion at all to help the patient that they are in fact hurting, the behaviors of Mr. G and United healthcare seem to be the definition of bad faith.

I can only hope that one day Mr. G is treated the same way he as treated K..

Bottom line: as noted above, I don’t anticipate United Healthcare changing their policy guidelines as a company-wide rule, but I also believe the way they obstructed any meaningful communication with me was inappropriate and in bad faith. I still would be interested in knowing what their medical director would suggest I offer as a treatment option in this case.

Additionally, I want those purchasing the insurance to know about the product they are buying and how much effort the insurance company has given to denying care.

I am willing to discuss this case further at any time.

Mark Wolgin, MD

drwolgin.com

_________________________________________

For those applying for disability benefits, along with fighting their insurance company, I found a link to an online guide that might be helpful by clicking here.